Managing your money has never been more important, especially in 2025 when personal finance apps are evolving faster than ever. Two of the most popular tools are Quicken and Mint, but many users struggle to decide which one is the best fit. If you’re comparing Quicken vs. Mint in 2025, this guide will help you understand the differences, features, and which tool suits your financial goals.

Quicken Overview

Quicken is decades-old software with more robust cloud-based offerings than less established companies. It’s meant for people and small businesses who need more specifics in accounting.

Key Features of Quicken:

- Keep a record of earnings, spending, investments, and debt.

- Advanced budgeting and forecasting tools.

- Bill management and reminders.

- Cloud sync across devices.

- Detailed tax summaries and export functions.

- Best For: Users who want hardcore financial tracking and long-term money management.

Mint Overview

Mint, owned by Intuit, is a free web-based and mobile app. It’s perfect for those who want simple, automated financial tracking without the complexity of professional accounting tools.

Key Features of Mint:

- Connect bank accounts, credit cards, and bills automatically.

- Real-time spending tracking.

- Budget creation and alerts.

- Free credit score monitoring.

- Easy-to-use dashboard and mobile interface.

Best For: Users who want a free, lightweight tool for personal budgeting and expense tracking.

Quicken vs. Mint: Side-by-Side Comparison (2025)

Feature Quicken Mint PricingSubscription-based ($2.99–$8.99/month) FreePlatform Desktop + Cloud Web + Mobile Budgeting Advanced with forecasting Simple budgeting Investment Tracking Yes (detailed reports) Limited Bill Payment Yes/NoCredit Score Monitoring NoYes Business Use Suitable for small businesses Not designed for business

Pros and Cons

✅ Quicken Pros:

- Powerful investment and tax tools.

- Offline and online access.

- Works well for households and small businesses.

❌ Quicken Cons:

- Requires a paid subscription.

- Steeper learning curve for beginners.

✅ Mint Pros:

- Completely free to use.

- Easy setup and automation.

- Great for beginners.

❌ Mint Cons:

- Limited advanced financial features.

- No offline access.

- Ads and promotional offers may be distracting.

Which Tool Should You Choose in 2025?

- Choose Quicken if you want professional-grade financial management, detailed reports, and tools for investments or small business accounting.

- Choose Mint if you want a free, simple, and mobile-friendly budgeting app for tracking day-to-day spending.

👉 In 2025, many users even combine both—using Mint for quick insights and Quicken for in-depth financial planning.

Final Verdict

When it comes to Quicken vs. Mint in 2025, the best choice depends on your financial needs.

- If you’re serious about long-term financial planning, Quicken is worth the investment.

- If you just need a budgeting tool without costs, Mint is the winner.

Both are excellent tools, but your decision should align with your financial goals and lifestyle.

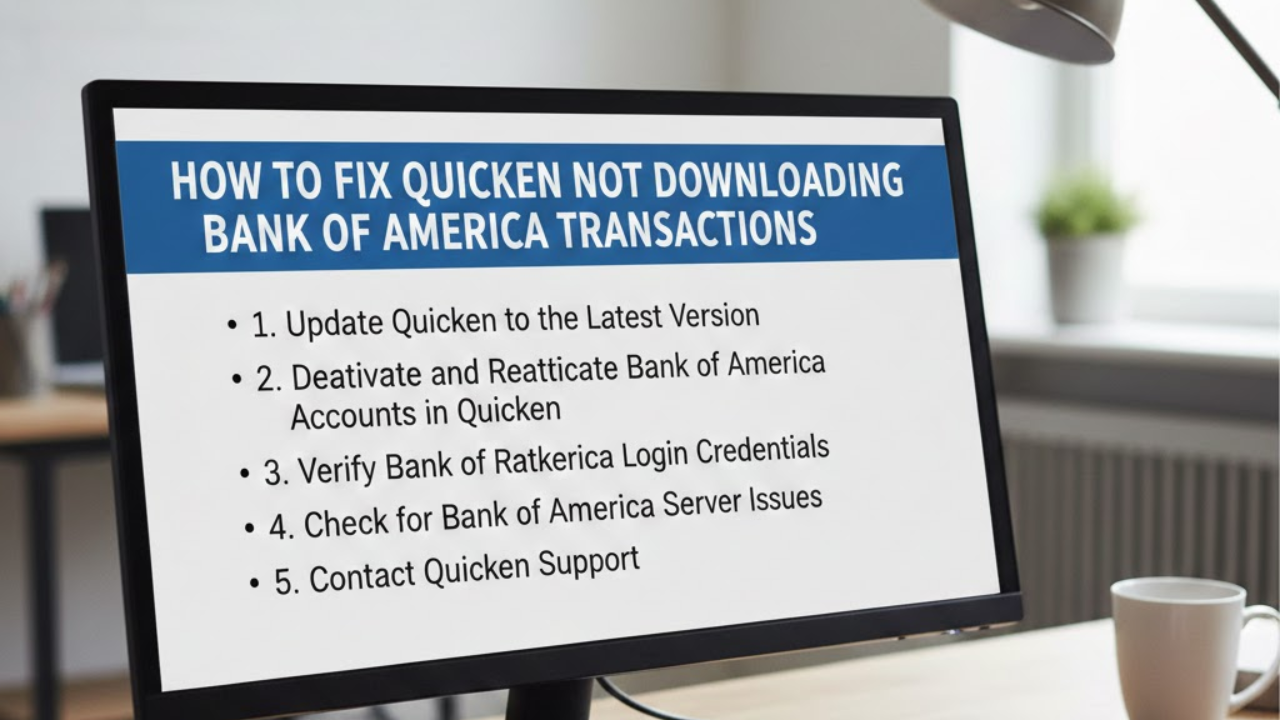

Read: How to Fix Quicken Error 103