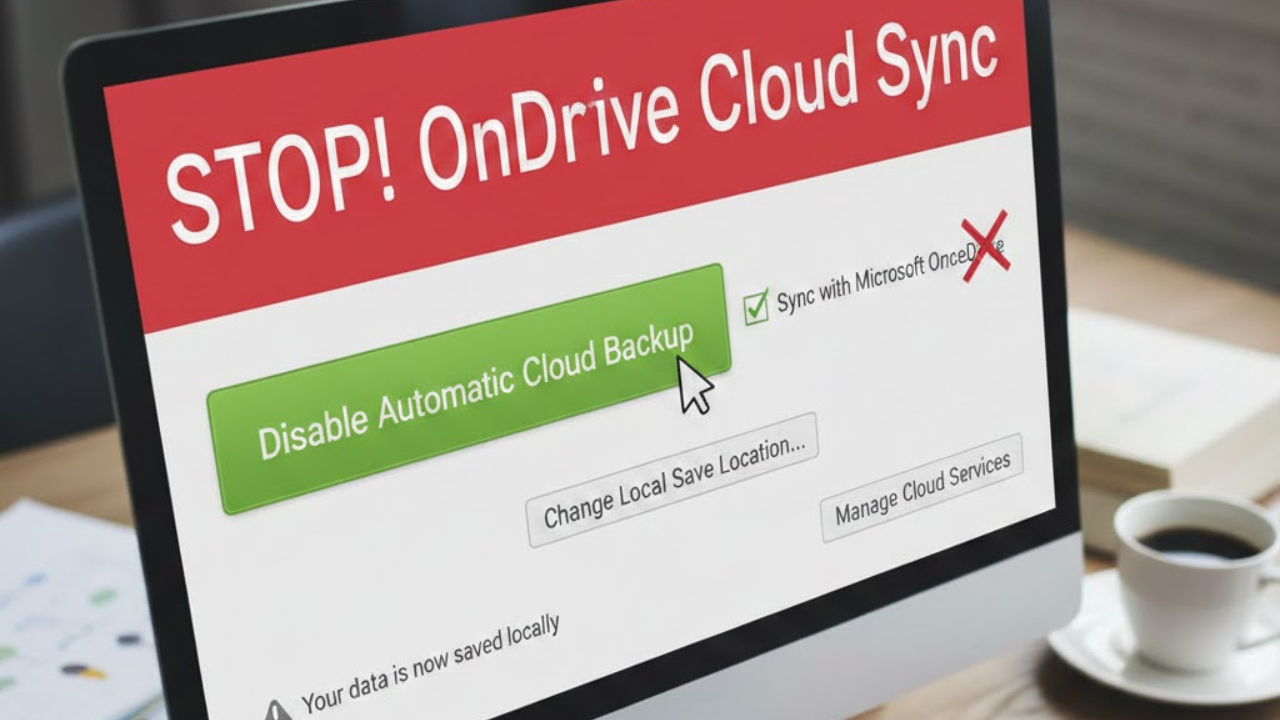

How to Stop Quicken from Saving Everything to OneDrive

Fix Quicken OneDrive sync issues on Windows by moving your Quicken data file out of OneDrive and stopping automatic folder backup. Many Windows users experience errors, slow performance, or file…

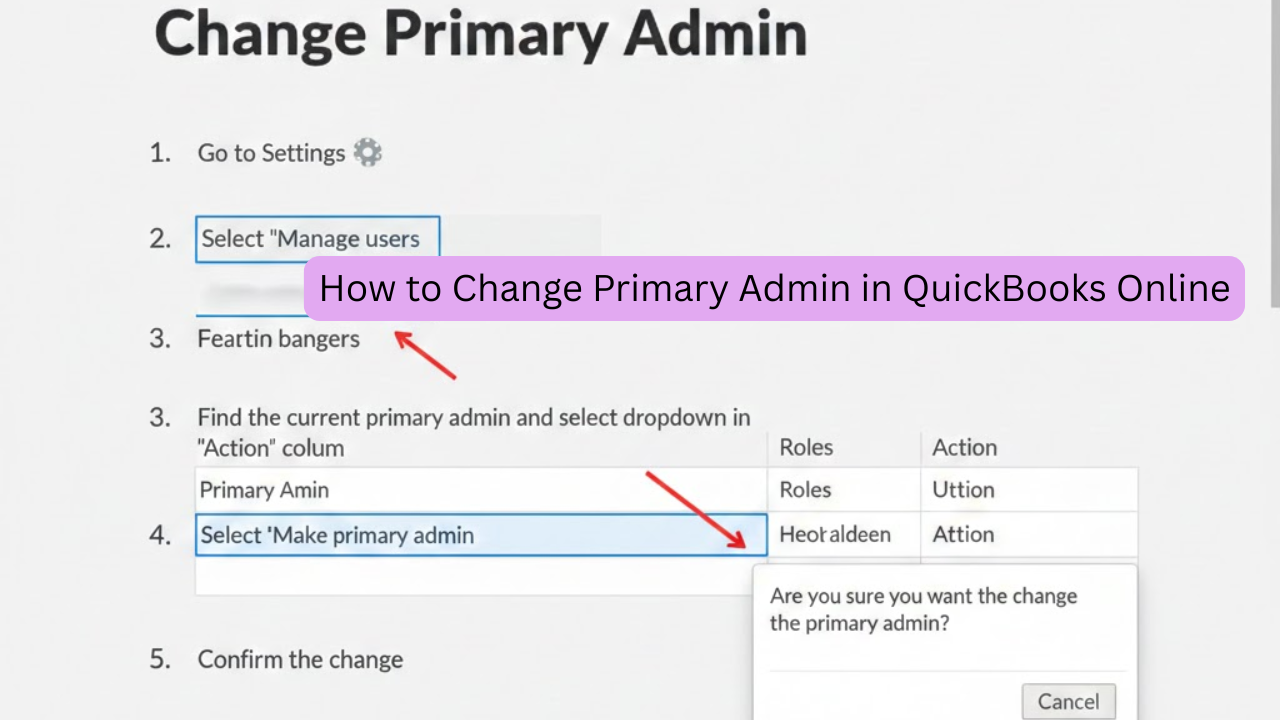

How to Change Primary Admin in QuickBooks Online (Step-by-Step Guide)

Managing user roles correctly is critical for business security and smooth accounting operations. If your business ownership or accounting responsibilities have changed, you may need to change the primary admin…

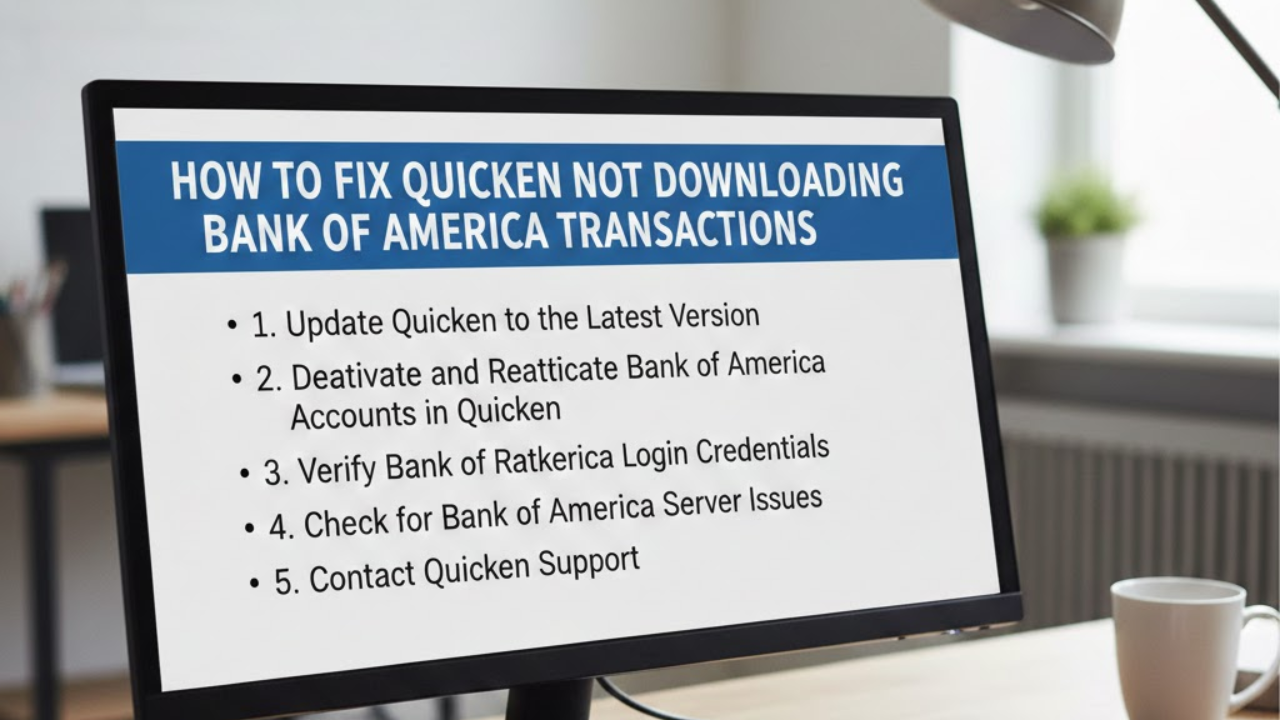

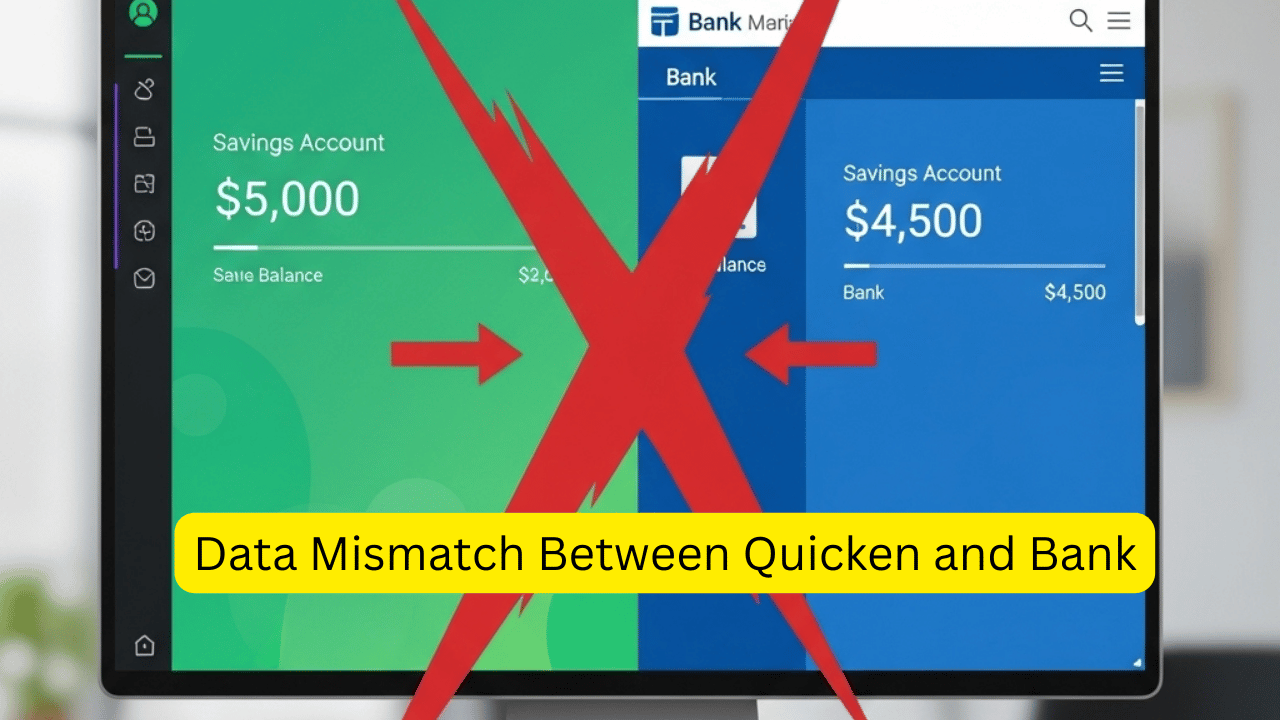

How to Fix Quicken Not Downloading Bank of America Transactions

If you are trying to download your Bank of America transactions in Quicken and nothing appears, you are not alone. Many users experience issues with missing transactions, connection errors, or…

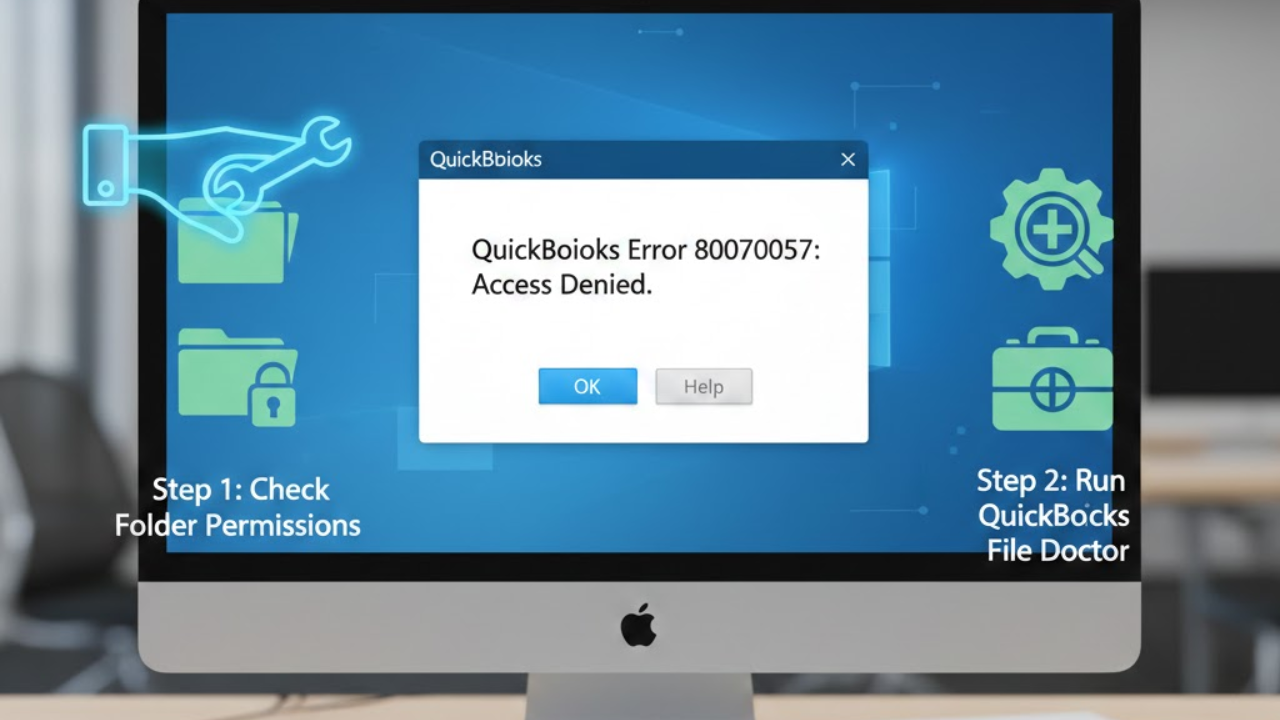

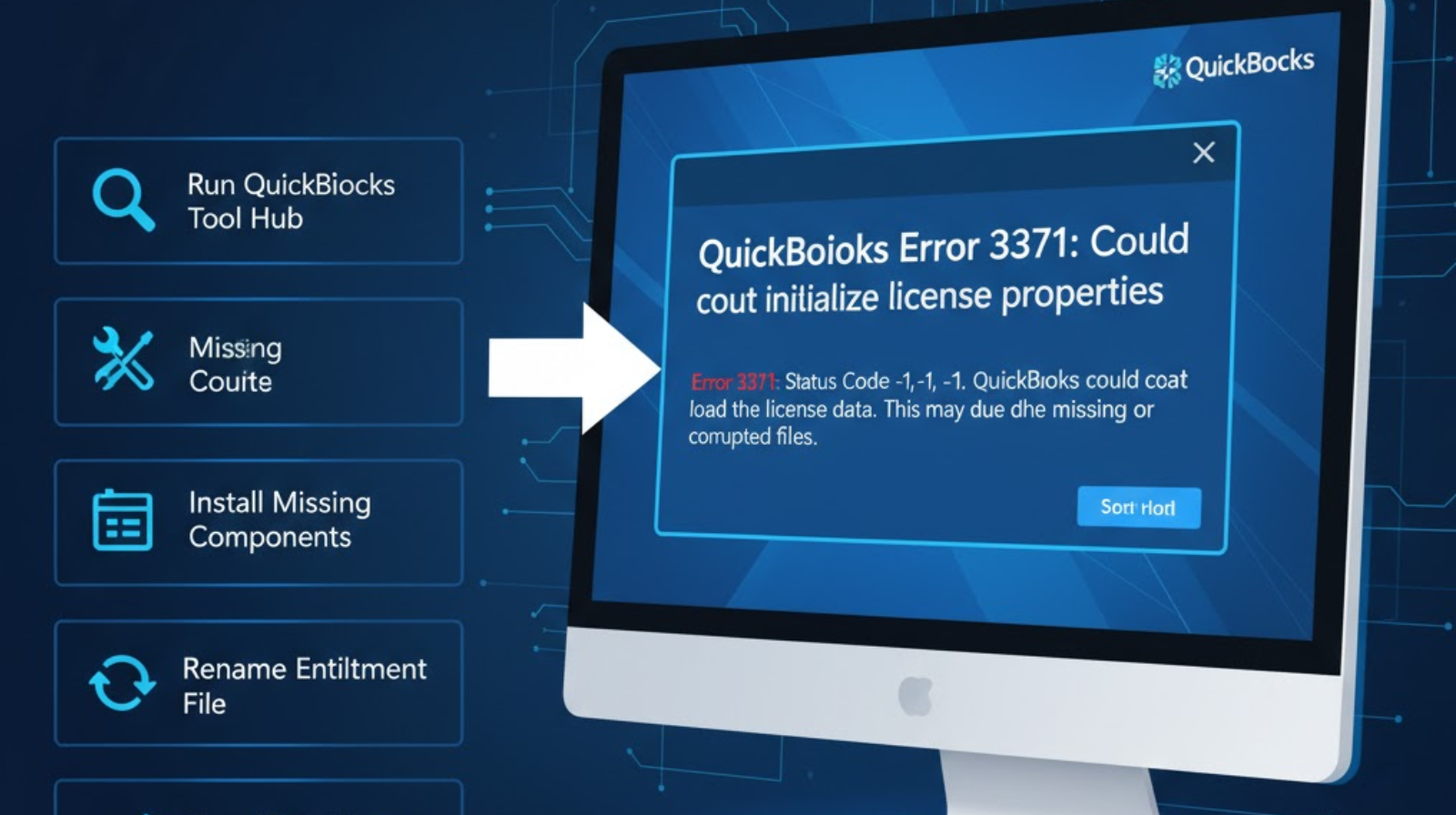

How to Fix QuickBooks Error Code 80070057 – Complete Troubleshooting Guide

If you use QuickBooks often, encountering technical issues can interrupt your workflow and create unnecessary stress. One of the most commonly reported issues is QuickBooks Error Code 80070057. This error…

Quicken Freezes on Startup? Here’s How to Fix It (Complete Troubleshooting Guide)

If Quicken freezes on startup, refuses to load your data file, or gets stuck on the splash screen, you’re not alone. Many Windows and Mac users experience this issue due…

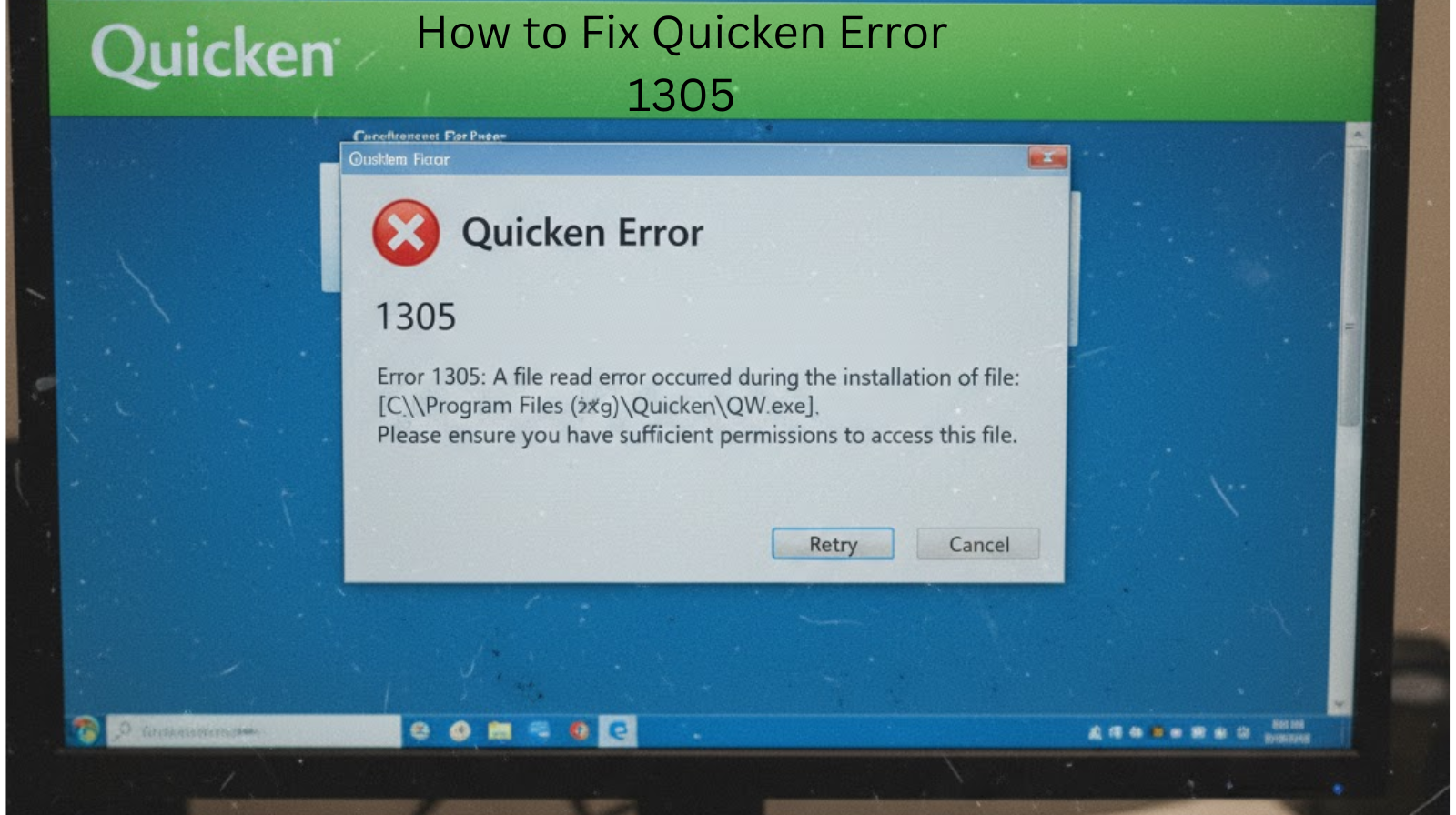

How to Fix Quicken Error 1305 When Installing or Updating Quicken

If you’re installing or updating Quicken and suddenly run into Error 1305: Error Reading from File, you’re not alone. This is a common installation issue that typically occurs when the…

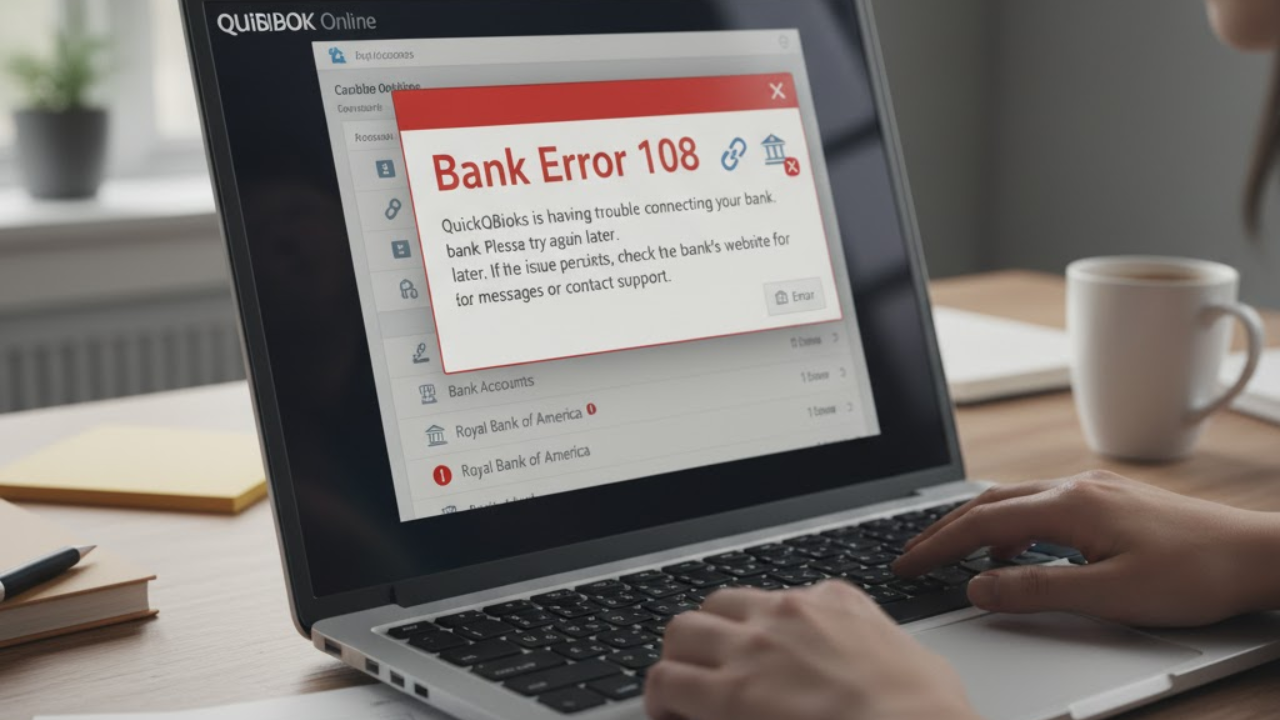

How to Fix Bank Error 108 in QuickBooks Online and QuickBooks Self-Employed

When you’re trying to connect or update your bank account in QuickBooks Online (QBO) or QuickBooks Self-Employed (QBSE), encountering Bank Error 108 can be frustrating. Fortunately, this is one of…

Quicken Freezes on Startup? Here’s How to Fix It

If your Quicken software freezes or becomes unresponsive right after startup, you’re not alone. Many users encounter this frustrating issue, especially after an update or when switching systems. The good…

How to Recover Lost Quicken Data After an Update: A Step-by-Step Guide

Updating Quicken is essential to keep your personal finance software secure and efficient. However, sometimes an update can lead to missing or lost Quicken data files—a frustrating issue for any…

How to Stop Quicken from Saving Everything to OneDrive

How to Stop Quicken from Saving Everything to OneDrive How to Change Primary Admin in QuickBooks Online (Step-by-Step Guide)

How to Change Primary Admin in QuickBooks Online (Step-by-Step Guide) How to Fix Quicken Not Downloading Bank of America Transactions

How to Fix Quicken Not Downloading Bank of America Transactions How to Fix QuickBooks Error Code 80070057 – Complete Troubleshooting Guide

How to Fix QuickBooks Error Code 80070057 – Complete Troubleshooting Guide Quicken Freezes on Startup? Here’s How to Fix It (Complete Troubleshooting Guide)

Quicken Freezes on Startup? Here’s How to Fix It (Complete Troubleshooting Guide) How to Fix Quicken Error 1305 When Installing or Updating Quicken

How to Fix Quicken Error 1305 When Installing or Updating Quicken How to Fix Bank Error 108 in QuickBooks Online and QuickBooks Self-Employed

How to Fix Bank Error 108 in QuickBooks Online and QuickBooks Self-Employed Quicken Freezes on Startup? Here’s How to Fix It

Quicken Freezes on Startup? Here’s How to Fix It How to Recover Lost Quicken Data After an Update: A Step-by-Step Guide

How to Recover Lost Quicken Data After an Update: A Step-by-Step Guide

![How to Fix Quicken Error CC-892: A Complete Troubleshooting Guide [2025]](https://allquicksolutions.com/wp-content/uploads/2025/08/How-to-Fix-Quicken-Error-CC-892.png)