Quicken is a personal finance management tool that helps you manage your finances, track expenses, create budgets, and plan for the future. Whether you’re new to Quicken or looking to maximize its features, this guide will walk you through the essential steps to get started and use Quicken effectively.

Getting Started with Quicken

1. Install Quicken.

First, you need to install Quicken on your computer. Follow these steps:

- Visit the Quicken website and purchase the version that suits your needs.

- Download the Quicken installer from the confirmation email or directly from the Quicken website.

- Run the installer and follow the on-screen instructions to complete the installation.

2. Set Up Your Quicken Account

Once installed, you’ll need to set up your Quicken account:

- Open Quicken.

- Click on Get Started.

- Sign in with your Quicken ID or create a new one if you don’t have an account.

- Follow the prompts to set up your profile and link your bank accounts.

3. Link your financial accounts

Quicken allows you to link various financial accounts, including bank accounts, credit cards, loans, and investments. Here’s how to link them:

- Go to Add Account.

- Select the type of account you want to add (e.g., checking, savings, or credit card).

- Search for your financial institution and enter your login credentials.

- Quicken will securely connect to your account and download your transactions.

Navigating Quicken

1. The Dashboard

The Quicken dashboard provides an overview of your financial situation. Here, you can see your account balances, recent transactions, budgets, and upcoming bills. Customize your dashboard by adding or removing widgets to suit your preferences.

2. Transactions

Managing your transactions is crucial for accurate financial tracking. Quicken automatically categorizes transactions, but you can manually adjust them if necessary.

- Go to Transactions.

- Review and edit the transaction categories.

- Add notes or tags for better tracking.

3. Budgeting

Creating and maintaining a budget helps you control your spending and save money. Follow these steps to set up a budget:

- Go to Budget.

- Click on Create a Budget.

- Enter your income and expenses.

- Quicken will generate a budget based on your historical data and goals.

- Monitor your budget regularly and make adjustments as needed.

4. Bill Management

Quicken’s bill management feature ensures you never miss a payment. Here’s how to set it up:

- Go to Bills & Income.

- Click on Add a Bill.

- Enter the bill details, including the payee, amount, and due date.

- Set up reminders and alerts to notify you of upcoming payments.

5. Reports

Generating reports helps you analyze your financial data and make informed decisions. To create a report:

- Go to Reports.

- Choose the type of report you want (e.g., spending, income, or net worth).

- Customize the report parameters.

- Save or print the report for your records.

Advanced Features

1. Investment Tracking

Quicken offers robust investment tracking tools to manage your portfolio.

- Go to Investing.

- Add your investment accounts.

- Track your portfolio’s performance, including stock prices, dividends, and capital gains.

2. Debt Reduction Planner

The debt reduction planner helps you create a strategy to pay off your debts.

- Go to Planning.

- Select the Debt Reduction Planner.

- Enter your debts, interest rates, and minimum payments.

- Quicken will create a payoff plan and show you the fastest way to become debt-free.

3. Tax Preparation

Quicken simplifies tax preparation by organizing your financial data.

- Go to Tax.

- Categorize transactions with tax-related tags.

- Generate tax reports and export the data to tax software or your accountant.

Tips for Using Quicken Effectively

1. Regularly update your transactions.

Ensure your financial data is up-to-date by syncing your accounts regularly. This helps you maintain accurate records and track your spending in real-time.

2. Reconcile your accounts

Reconcile your bank and credit card statements monthly to ensure your records match your financial institution’s records. This helps identify any discrepancies or fraudulent transactions.

3. Backup your data.

Regularly back up your Quicken data to prevent loss of information. Use Quicken’s cloud backup feature or save your data to an external drive.

4. Use the Quicken Mobile App

Take advantage of the Quicken mobile app to manage your finances on the go. The app syncs with your desktop version, allowing you to track transactions and view your budget anytime, anywhere.

Conclusion

Quicken is a powerful tool for managing your personal finances, offering a wide range of features to help you stay on top of your financial health. By following this guide, you can set up and use Quicken effectively to track expenses, create budgets, manage investments, and prepare for taxes. Regularly update and back up your data, and take advantage of Quicken’s mobile app to manage your finances on the go. If you encounter any issues, Quicken’s support team is available to assist you. Start using Quicken today to take control of your financial future.

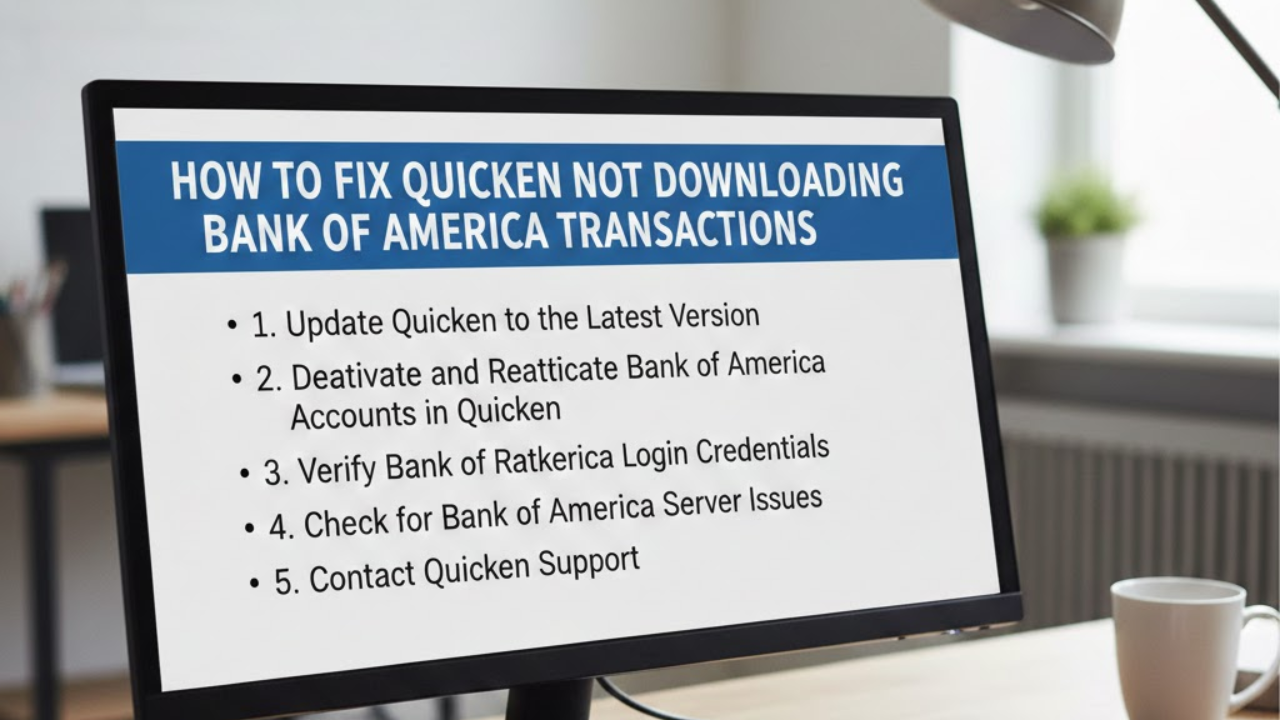

For any Quicken-related issues or Quicken expert help, feel free to contact our support team. We are here to assist you 24/7 with all your Quicken needs.